The price of Bitcoin hit a new all time high of almost $20,000 USD yesterday. In this post I’ll make the case for why the upcoming bull run is inevitable.

Brief update

I was rereading my April blog post in which I rambled on about both the pandemic and money printing. This post will be focused on just Bitcoin (I’ll write another for the pandemic and gov’t responses).

In short, Bitcoin is very much alive and thriving.

The highly anticipated Bitcoin block reward halving went smoothly. As of block 630,000 the reward is now 6.25 bitcoin per block mined. There was a brief dive in hashpower, but it quickly rebounded and broke all time high several times. Currently it is sitting pretty at 134.4 EH/s. The Bitcoin network is secure.

The price was trading sideways for a few months, until the recent run that broke the all time high, which was established almost exactly 3 years ago. We also haven’t seen any significant dips. The last of which was around 15%.

See below, the impressive run from ~$10,000 to $19,800 from September to November of 2020:

The price of Bitcoin seems to be finding a new floor around $19,000 USD. Now onto my thoughts about why the upcoming Bitcoin bull run is inevitable.

Bitcoin is scarce

Let’s take a step back and revisit why Bitcoin has any value at all. I see an argument made that Bitcoin has no intrinsic value, that it is just numbers on some shared ledger and nothing more. Nothing has intrinsic value. Value is subjective. Water to the thirsty is infinitely valuable with sufficient thirst.

In my view, the value of Bitcoin is derived mainly from its scarcity. There will only be 21 Million bitcoins ever created. Bitcoin is the most scarce commodity that has ever existed. This game is one of accumulation. How many of the 21 Million bitcoins can you accumulate?

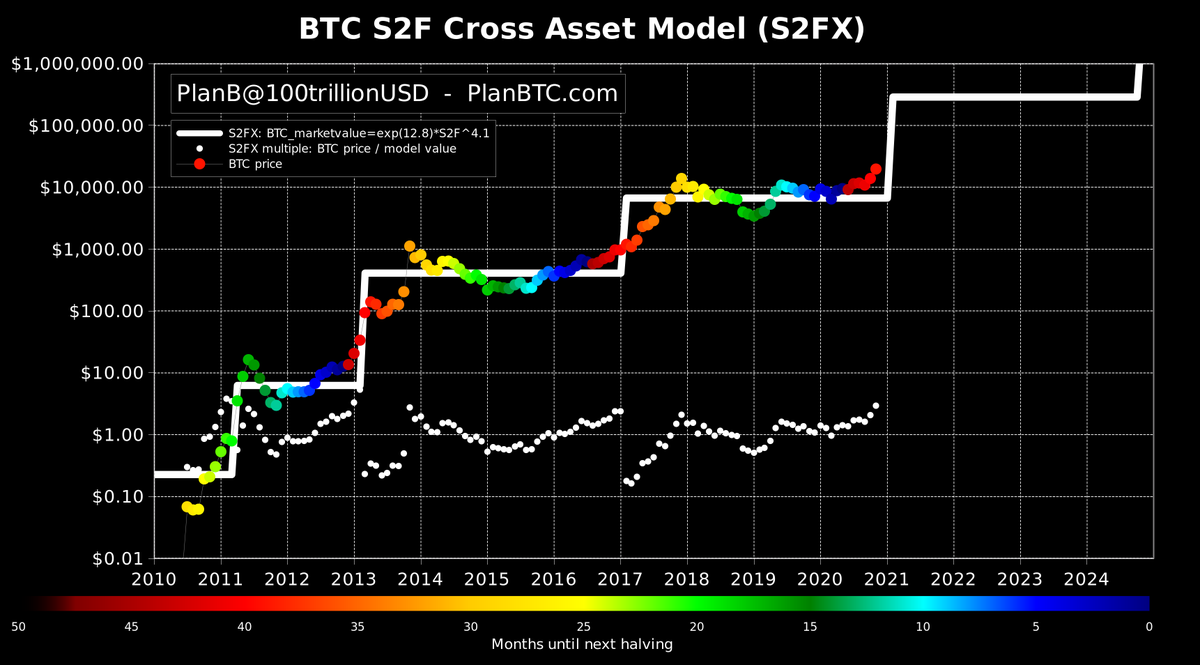

This is nothing new for readers who keep up with this space. PlanB created a model that very accurately predicts the price of Bitcoin using only it’s scarcity. Read more on the model on his post Bitcoin Stock-To-Flow Cross Asset Model.

Once we have realized that Bitcoin is scarce, that new supply cannot be easily introduced to the market, we come to the wonderful realization that the only variable in the calculation of the price is demand. Consumer demand for the limited supply of bitcoins. However, this is also a double-edged sword in that if the demand for Bitcoin falls, then price will plummet. I leave it to you dear readers to assess the risks of owning bitcoin yourselves. My 2 cents on this matter is that there is no risk significant enough to ward you off from having even a small percentage of your portfolio exposed to Bitcoin’s tremendous volatility.

Bitcoin’s supply cannot be modified, and the demand for this asset is quickly rising. 🚀

The Market is Cyclical

Bitcoin's price is so cyclical, it's not even funny!

Take a look at any chart of bitcoin’s price over a significant enough time and you will quickly see that there are clearly 4 year cycles that are repeated after each halving. Here is one from PlanB again, we can pretty quickly see the peaks of the price movements and see that we are just about to start the 4th iteration of that cycle.

In the above linked article, PlanB predicts prices north of $288k USD for this upcoming cycle. We shall see, dear readers in the coming years how accurate his model is. I also like Vijay Boyapati’s 4 valuation frameworks for Bitcoin’s price.

We are talking very very big numbers here.

Bullish Sentiment is Everywhere

Even if you don’t follow this space, I’m sure that you have been bombarded with some news article or another talking about some Bitcoin event. I’ll recap some of the most bullish recent events below:

- MicroStrategy buys 38,250 BTC (Cost: $425M, current value: $720M)

- Many well know “celebrity” investors are now open about their positions in Bitcoin, billionaires like Paul Tudor Jones, Stanley Druckenmiller, Bill Miller and so many more

- PayPal opening up Bitcoin purchases for their customers (PayPal and CashApp, just 2 exchanges, are eating up ALL of the newly minted bitcoins)

- Bitcoin holders are pulling their bitcoins out of exchanges - there is very limited amount left available for sale

The list is exhaustive…

I think the most bullish thing that I’ve seen is that there are no credible Bitcoin skeptics left. There are no bears. Nobody wants to short Bitcoin and nobody wants to risk their reputation and come out strongly against it.

The upcoming bull market is inevitable. Prepare accordingly, dear readers.